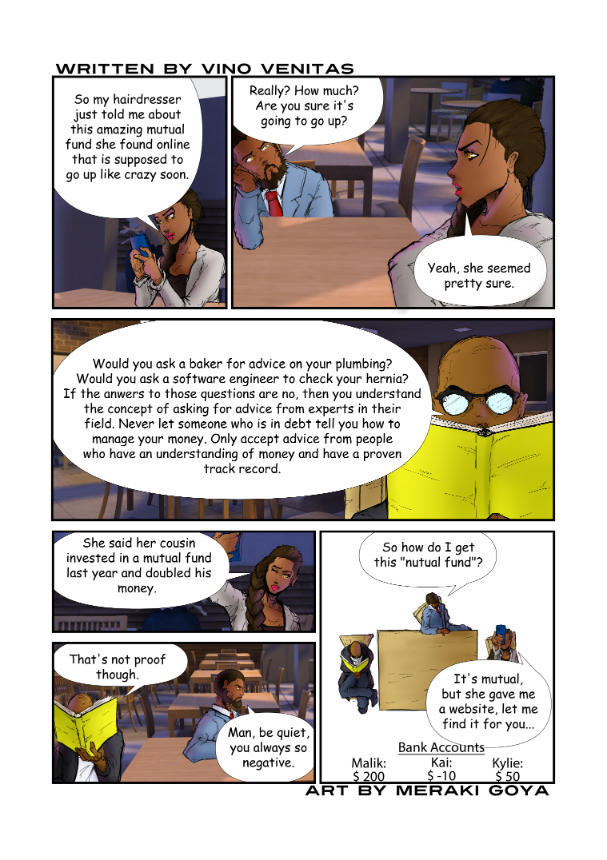

Why Only Accept Financial Advice from Those with True Money Knowledge

Introduction: In the vast landscape of personal finance, advice often flows freely from various sources—friends, family, colleagues, and the internet. However, not all advice is created equal, especially when it comes to managing your hard-earned money. In this article, we’ll explore why it’s essential to discern and only accept financial guidance from individuals who possess genuine knowledge and expertise in handling finances.

- Expertise Matters: When seeking advice on personal finance matters, it’s crucial to consider the source’s level of expertise. Those with a deep understanding of financial principles, such as certified financial planners, economists, or experienced investors, are better equipped to provide informed guidance tailored to your specific needs and goals.

- Avoiding Misinformation: In today’s digital age, misinformation spreads rapidly, particularly in the realm of personal finance. Following advice from individuals lacking true money knowledge can lead to costly mistakes and financial setbacks. By consulting with trusted experts, you can mitigate the risk of falling prey to inaccurate or misleading information.

- Customized Solutions: Every individual’s financial situation is unique, influenced by factors such as income, expenses, debt, and long-term goals. Only advisors with a solid understanding of financial principles can offer personalized solutions that align with your circumstances and aspirations. Generic advice from ill-informed sources may not address your specific needs effectively.

- Minimizing Risks: Investing, saving, and managing debt all involve inherent risks. Seeking advice from individuals with genuine money knowledge can help you navigate these risks prudently. Experienced advisors can offer insights into risk management strategies, asset allocation, and diversification, empowering you to make informed decisions to safeguard your financial future.

- Maximizing Returns: Whether you’re planning for retirement, saving for a home, or building wealth for the future, the ultimate goal of sound financial advice is to maximize returns on your investments and savings. Advisors with in-depth knowledge of money management can devise strategies to optimize your financial resources, helping you achieve your goals more effectively and efficiently.

Conclusion: In a world inundated with financial advice from various sources, it’s imperative to exercise discernment and only heed guidance from individuals with true money knowledge. By consulting with experts who possess the requisite expertise and experience, you can make informed decisions, mitigate risks, and chart a path toward financial security and prosperity. Remember, when it comes to your money, quality advice matters most.